Welcome to

Fred & Jessi on the road

Revolutionize your Banking for Travels (1.12)

There is a moment on long motorcycle journeys when you stop fighting the road and start flowing with it. You stop forcing speed, stop overthinking every curve, and simply ride. That same moment of relief is rare in banking, especially when your life and business stretch across borders.

This article is about what happens when you finally remove that friction and let your money move as freely as you do.

I live that reality every day. I am German, I run a German GmbH, I live in the United States, and I operate a U.S. LLC. That means private finances, two business realities, two legal systems, and two fundamentally different banking infrastructures.

Add frequent travel, international clients, and digital tools, and traditional banking quickly turns into a constant background struggle. I needed speed, control, and clarity. For the last two years, I have found all three with Revolut.

When Banking Becomes a Roadblock

Most banks are built for stationary lives. One country. One currency. One legal framework. The moment you step outside that model, cracks start to show. Transfers take days. Fees stack up quietly. You lose track of which account holds what money and which card is connected to which service.

The real problem is not inconvenience. It is mental load. Every delay forces you to plan around your bank instead of letting your bank support your decisions. Just like riding with bad suspension, you can still move forward, but every mile costs more energy than it should.

A Complicated Setup That Needed Simplicity

My personal setup is not theoretical. It is daily life. I need a private account for living expenses. I need a business account for my U.S. LLC. I also need a business account for my German GmbH. My clients are based in Europe and the United States. I work mainly in euros and U.S. dollars. I travel often and manage everything remotely.

What mattered to me was not flashy features. I needed fast transfers, clean currency handling, and absolute spending control. Anything else would just be noise.

Bridging Two Banking Worlds

One of the biggest advantages of Revolut is how it connects American and European banking systems. ACH transfers, wire transfers, and SEPA payments live under one roof. I do not need to think about which system I am using. I simply move money where it needs to go.

Inside both my private and business accounts, I can hold multiple currency balances. Euros and U.S. dollars sit side by side. Moving money between them takes seconds, not days. There are no artificial delays and no forced conversions. That alone removes a surprising amount of stress from daily operations.

From a devil’s advocate perspective, one could ask whether this flexibility comes at the cost of reliability. My experience says no. Over two years of use, transfers have been consistent, predictable, and transparent. That reliability is what turns a tool into infrastructure.

Cash Flow Without Waiting Games

Cash flow is oxygen for any business. When money is stuck in transit, decision making slows down. My customers in Europe and the U.S. can pay me via wire transfer or through Stripe. Once Stripe releases the funds, I transfer them to my Revolut account and they are available almost immediately.

This matters more than it sounds. Knowing exactly when money is usable changes how confidently you operate. There is no guessing and no checking balances multiple times a day. Even smaller cases, like selling a few items on eBay, work smoothly. Connecting my Revolut private account to eBay took minutes, not emails and forms.

A fair question is whether speed ever compromises compliance or security. In practice, Revolut balances both well. Transfers are fast, but verification and security are always present in the background.

Spending Control That Matches Reality

If there is one feature that truly changed my day to day operations, it is spending control. I use many online tools and marketing systems. Instead of charging everything to one card, I create dedicated virtual debit cards for each service. Every tool gets its own card.

This gives me complete visibility and hard limits. If a service is meant to cost a fixed amount, that is exactly what it can charge. Nothing more. When a subscription continues charging after cancellation, I freeze the card instantly. No support tickets. No discussions. The payment simply stops.

Some might argue that this level of control is excessive. From experience, it is not. It replaces constant monitoring with quiet confidence. Just like a well set up bike, you stop checking every bolt and start enjoying the ride.

Physical Cards for Life on the Road

Digital tools are powerful, but the physical world still matters. Revolut provides physical cards as well. Plastic cards are free and shipped by mail, and there is an option for metal cards if you prefer. I use them for daily expenses, travel, rentals, and everything that happens off screen.

What matters is that the physical and digital sides work together. One app controls everything. There is no disconnect between what happens online and what happens on the road.

One App, One View, Less Noise

Everything lives in one place. I can access my accounts from my PC, but most of the time I use the smartphone app. Transfers, balances, limits, card management, and security are all handled there. Face recognition on my iPhone makes access fast and secure.

For all of this, private and business accounts included, I pay around ten dollars per month. From a critical perspective, one could question whether relying on one platform is wise. My answer is simple. The clarity and control gained far outweigh the risk of fragmentation across multiple banks.

A Simple Action Plan

Before changing anything, it helps to pause and take an honest look at your current situation. Banking habits often grow organically and rarely get redesigned on purpose. This short action plan is meant to help you evaluate whether a setup like this fits your reality.

1. Review your current setup.

Look at how many accounts you use, how long transfers take, and where delays or hidden costs appear. Pay attention to how much mental energy banking consumes.

2. Map your currencies and payment flows.

Identify where your money comes from and where it needs to go. Consider how often you move between currencies and systems.

3. Explore the Revolut details.

Visit the Revolut Internet-Page and review the options for private and business accounts. Focus on transfer speed, currency handling, and spending control rather than extras.

4. Start small and test it.

Sign up and try one use case. Move a payment. Create a virtual card. Transfer funds between accounts. Experience how it feels in daily use.

5. Evaluate after real usage.

After a few weeks, ask yourself whether banking feels lighter. Less noise usually means the system fits.

Closing Thoughts

Good banking should feel like a well maintained motorcycle. Reliable, predictable, and invisible when everything works. For me, Revolut removed friction from a complex international setup and gave me back mental space. That space is better spent riding, building, and deciding where the road goes next.

If your business and life cross borders, your banking should not hold you back. It should quietly support the journey.

Fred, Jessi & iFred - On the Road for You

Fred, Jessi & iFred. On the road, living free and sharing our adventures. Fred rides, Jessi carries, and iFred connects the stories.

This time, our journey taught us about cross border banking clarity, powered by the freedom from My Easy Side Business.

updates

updates

Social Media

Business

Blog Categories

Why I Ride and Write

Featured Articles

From our YouTube Channel

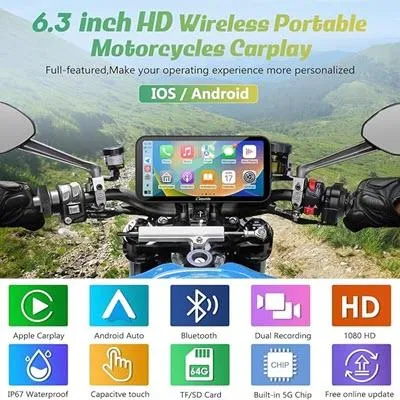

promotion zone

Best Action Cameras for Motorcycling

Brainfood for your Trip

A legendary investor’s 22-month, 52-country motorcycle odyssey - part travelogue, part investor’s world tour. Inspires freedom, global perspective, and smart risk-taking across borders.

A philosophical classic that blends motorcycle travel with deep reflections on quality, purpose, and personal growth. Perfect for riders who want the inner journey as much as the road itself.

The drummer of Rush sets off on a long motorcycle journey after tragedy. The road becomes medicine, clarity, self-reinvention. Strong emotional and personal-development themes that match your “roads instead of retirement” concept.

Not motorcycle-specific, but the best book on slow travel, simplicity, freedom, and building a life around experiences rather than routine. Perfect match for your lifestyle theme.

A transformative motorcycle journey across Latin America that changed the author’s worldview forever. A great match with your Mexico–Central America series and your theme of being shaped by people and landscapes.

A modern classic of motorcycle adventure. Beyond the travel story, it’s about friendship, problem-solving, risk-taking, and how extreme travel forces personal evolution. Fits your “experience, not gear” philosophy.

disclaimer

The recommendations and insights shared on www.FredJessi.com and www.BizBiker.com by Sysbizz LLC are based on our own riding experience and independent research. We are not responsible or liable for any outcomes, injuries or damages, or related to the use of products or information mentioned.

Some content referenced in our blog articles originates from third-party creators and is shared for inspiration and additional perspective. Fred & Jessi does not create, control, verify, or endorse this external content and is not responsible for its accuracy, completeness, or expressed opinions.

Links on this page may be affiliate links. We may earn a commission from qualifying purchases made through these links, at no extra cost to you.